Home » Flygindustrin

Category Archives: Flygindustrin

Anders Ellerstrand: Eurocontrol om flygbranschens utveckling

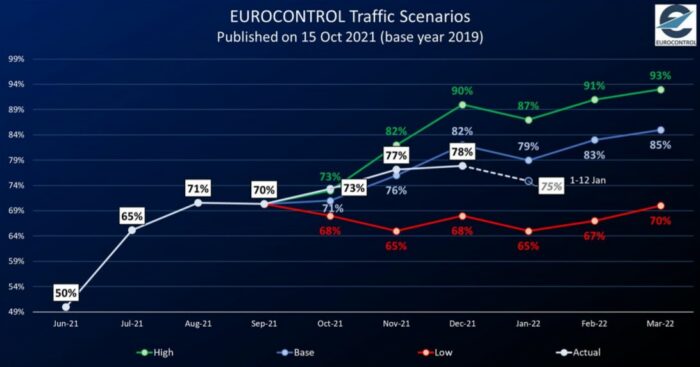

Senast jag skrev om detta var i september förra året. Då var den faktiska återhämtningen för flygtrafik snabbare än den mest positiva prognosen. Hur ser det ut nu?

Den blå linjen visar en bas-prognos medan den gröna linjen visar den mest positiva prognosen och den röda en mer pessimistisk. Den vita linjen visar den faktiska utvecklingen och som synes ger den senaste tidens kraftiga spridning av omikron-varianten (och de restriktioner som införts) tydligt utslag. Vi ligger nu på en nivå motsvarande 75 % av trafiknivån från 2019, där prognosen pekade på 79 med hopp om 87 %.

Fortfarande dominerar inrikestrafik, där Frankrike hade 896 inrikesflygningar, Spanien 817 och Norge 631, alla siffror från 12 januari. Sverige klättrar i den rankingen och är på en nionde-plats med 206 flygningar. Det flygbolag som flyger mest är Ryanair som hade 905 flygningar 12 januari (-49 % om man jämför med 2019). Sedan följer Turkish Airlines med 888 flygningar (-27 %), Lufthansa med 669 flygningar (-53 %), Air France med 658 flygningar (-42 %), KLM med 521 flygningar (-28 %), Wizz Air med 372 flygningar (-17 %) och SAS med 342 flygningar (-53 %).

Det är en hårt drabbad bransch som nu ska hantera även detta. Dessutom stiger bränslepriserna! Den mest aktiva flygplatsen i Europa 12 januari var Istanbul (826 rörelser), följd av Paris (794 rörelser), och Amsterdam (793 dagliga rörelser).

Den gällande prognosen kom förra året:

Den mest positiva kurvan visar att en återhämtning till nivån från 2019 kan nås i år, basnivån säger slutet av 2023 medan en mer pessimistisk prognos säger 2027.

För Sveriges del har det inte kommit nya siffror från Transportstyrelsen sedan i slutet av oktober. Då såg man en tydlig ökning. Under det tredje kvartalet 2021 flög över 4,1 miljoner passagerare till och från svenska flygplatser vilket var 2,5 miljoner fler än under samma period 2020.

Planes vs. Trains – A complex issue

Comparing planes to trains could be seen as a topic better avoided for those of us who work in the aviation industry. Because it is a topic about competition that has already affected the industry in a number of countries, or has the potential to do so. The topic is not new but given the relatively slow progress of high-speed trains in recent decades it has been more of an evolution than revolution. The arguments for and against each mode of transport are also not new, with time of travel, environment, accessibility, infrastructure and others being part of them. Comparing planes to trains can unfortunately become more political than pragmatic and polluted with arguments that may not be as complete and transparent as they should be. This situation is made even more difficult as different lobbying groups may cite research funded by the respective group. In this post we will try to keep it simple, as a few examples will be brought up to illustrate the topic, and some considerations in relation to the topic will be presented.

The development of high-speed trains is probably best known in connection with the TGV trains in France or the ICE in Germany. Many would also have heard of the large scale development of a high-speed train network in China. However, the highest number of kilometers of high-speed railway in Europe is in Spain (link to article below). This has been a slow development over recent decades, but as more operators are competing on this network there is an expectation of a coming increase in passengers. Still, even today and with this competition, the flight between Madrid and Barcelona is the busiest short-haul route in Europe. This may however change as two new low-cost train companies have begun operations this summer, offering basic fares below 10 Euros for the trip between the two largest cities of the country.

Another case study can be found in Italy (link below). Here, the evolution of high-speed rail transport is seen as a reason for why Alitalia could not survive (the dysfunctionalities of Alitalia and competition from low-cost carriers were probably other important reasons). The main travel route between Milan and Rome is three hours by high-speed train, which should be compared with a drive to the airport, checking in an hour before a flight, an hour in the air and then another drive to get into town. The result has been that passenger numbers on high-speed trains in Italy has gone from 6.5 million in 2008 to 40 million in 2018. In 2018 69% of all passengers going between Rome and Milan used the train, which represented an increase of more than 7% over three years, while air travel lost about the same amounts of passengers in the same time period and was left with less than 20% of the market on this route.

These examples are typical for the competition situation between high-speed trains and air travel. Comparisons between the two on short-haul routes (link and link) shows similar total journey times. While there used to be a cost gap in favour of planes, this gap shrinks as soon as there is competition on the high-speed train routes. Service levels in terms of frequency and onboard service has previously been an advantage for air travel, but this gap can also be reduced by train operators. With concerns about the environment favouring trains, the results is that flying comes under severe competitive pressure from high-speed trains.

However, these are the easily visible arguments. There are other arguments to consider as well and foremost is the large-scale investment cost required for high-speed rail transport. There have been reviews of this (such as link and link) and to quote from the first link, an analysis from Leeds University: “Decisions to invest in this technology have not always been based on sound economic analysis. A mix of arguments, besides time savings, strategic considerations, environmental effects, regional development and so forth have often been used with inadequate evidence to support them.” To summarise further arguments in the same paper, the investment cost for high-speed rail can be motivated only in the unusual circumstances of low construction costs plus high time savings (because of poor existing rail lines and inadequate services on competing modes of transport), and with for a level of at least 6 million passengers per year (for more typical construction costs and time savings, 9 million passengers per year is required).

In another report (link), the following conclusion is drawn related to the environment: “Investment in high-speed rail is likely to reduce greenhouse gases from traffic compared to a situation where the line is not built. The reduction, though, is small and it may take many decades for it to compensate for the emissions caused by construction. In cases where anticipated journey volumes are low, it is not only difficult to justify the investment in economic terms, it is also hard to defend the project from an environmental point of view.” This brings in an environmental aspect on the sizeable investment needed for high-speed rail.

So, while not denying any of the advantages of high-speed rail transport, the question is if the vast resources required for this mode of transportation could be used differently and more efficiently to achieve the same goals. Also, the time frame for the project is important – a comparison of the different modes of transportation today may be irrelevant in 20 years due to new innovations. And for large projects like these it is often public funds that are used and which are at risk if the project is not successful, not private funds, as is more common in aviation. As an example, if even some of these funds in recent decades had gone to develop alternatives to jet fuel (sustainable fuel, batteries, hydrogen) perhaps aviation could have been carbon neutral already? This demonstrates that the full picture of a long-term and complex issue as this one must be thoroughly investigated, preferably by a third party entity. In the end, it is likely that high-speed rail is the best solution in a number of scenarios, but equally likely that there are many scenarios considered today where it will not be the best solution. Let us hope that pragmatism will be what decides which is the best solution for different scenarios.

Link to articles:

Spain’s high-speed railway revolution

How Italy’s high-speed trains helped kill Alitalia

Gary Martin: Air Cargo and Security

This post is by a new visiting writer, Gary Martin, Avsec Training Manager at G4S SECURE SOLUTIONS in IRAQ. I am grateful to Gary for adding the security perspective to the Lund University School of Aviation blog. We are always welcoming fellow aviation professionals to post on the blog and to add perspective, new information and sharing of practice in the industry.

This article follows up from a comment I made to a post that my good friend and ex-colleague Nicklas Dahlstrom had written about air cargo (link) and the important role that it played during the COVID-19 pandemic. In my comment I highlighted the fact that air cargo is viewed as the weakest link within aviation security and that it was being exploited by drug smugglers. They would facilitate their illicit trade in moving narcotics through borders with limited checks as they were in shipments of COVID-19 vaccinations and or PPE (mask, gloves etc) which were urgently required in many countries around the world.

I went on to say that it could have been very easy for these narcotics and other illegal contraband, to be replaced with an Improvised Explosive Device (IED) and therefore bring the aircraft down, potentially over a heavily populated city. Can you imagine the devastation not just to the city below but to the entire cargo network, more especially during a pandemic when cargo was so critical in moving PPE and medical supplies. With passenger traffic dropping 63% during the first 10 months of 2020, cargo saw a relatively smaller reduction of 11%, with some airlines even choosing to use passenger aircraft as cargo due to the high demand.

Let’s go back before the pandemic and look at air cargo and the view that it was and possibly still is the weakest link. With advances in passenger screening after incidents such as with Richard Reid, the “Shoe Bomber” and Umar Farook, the “Underpants Bomber”, and the 2006 liquid bomb plot, there were various pieces of equipment, processes and procedures that were introduced to combat these new and emerging threats from the terrorist.

It wasn’t really until October 2010 and what has now become known as the cargo bomb plot that emphasis really switched to the security measures that were in place for air cargo. Two packages were loaded onto a UPS and FedEx cargo aircraft. The cargo itself were printer toner cartridges addressed to synagogues in Chicago originating from Yemen. That in itself should have been an immediate red flag. Ship printer cartridges from Yemen to Chicago. Now we all know that Yemen is the central hub for printer cartridges, right? Both packages had been on several passenger aircraft as part of their trip to Chicago. One was eventually detected at East Midlands Airport, after around 10 hours and several conversations with Saudi and Dubai authorities who had already found the other device in Dubai.

After this event, legislation had to change, and it did. Europe introduced ACC3 which was designed to improve screeing of cargo from a third country airport flying into the EU. There were also other changes to the screening of cargo, with the introduction of the use of dogs for detecting explosives and vapour detection technology. The whole supply chain was revamped, with known consignors and regulated cargo agents having more stringent security controls in place. Cargo screening is now finally catching up to the same level as passenger screening, there may still be a bit to go, but it is certainly going in the right direction.

According to IATA, airlines transport over 52 million metric tons of goods per year, representing more than 35% of global trade by value but less than 1% of world trade by volume. That is equivalent to $6.8 trillion worth of goods annually, or $18.6 billion worth of goods every day. As you can see, cargo is a very lucrative business and one where security controls must be as tight and secure as they possibly can be, even more so in the current climate when the transportation of pharmaceutical cargo is especially important for us all.

Air Cargo – An important but less famous part of the aviation industry

There are things that “everyone” knows that seemingly very few people actually do know. The other week this blog brought up such a thing, namely who is flying as passengers and who is not (link). For experts in the aviation industry and academia this was an issue that probably is well known, but perhaps not by many more than those experts. Today, we are bringing up a similar topic – the transport of goods via air around the world, i.e. air cargo. As much as it may be argued that “everyone” knows also about this topic, air cargo is probably not something that many has a good knowledge about. Even those who work outside of air cargo in the aviation industry often do not know much about it. So, here is a small overview of this crucially but less famous part of the aviation industry.

Airlines and traffic with passengers get most of the attention in the aviation industry, but the pandemic has showed how important the cargo part of the industry is. Still, it is not easy to find numbers that demonstrate this importance, at least not in comparison to passenger traffic. This is partly because a lot of cargo travels in the belly hold of passenger aircraft. A study from Cranfield stated that in 2013 half of worldwide cargo was transported in cargo aircraft and the other half in belly holds (link). This number has been stable for some time and while it has been expected that belly hold will increase, a 2018 forecast predicts that this will not happen untol 2037 (link).

As per IATA, the airlines represented by the industry organisation transport more than 50 million tons of goods annually. This is just one percent of world trade by volume, but more than a third of the total value. According to a study by the World Bank (link) the price of air cargo is about four to five times that of road transport and 12 to 16 times that of maritime transport. This is why air cargo is only competitive if what is shipped is of high value per unit and time for the transport is an important factor. This means that documents, medicine and medical equipment, perishable produce and seafood, expensive electronics and clothing, emergency spare parts, and inputs to just-in-time production are examples of items which are suitable for being transported as air cargo. The advantage of speed of delivery can be offset against the disadvantage of a higher cost for these types of items.

The COVID pandemic provided an unexpected and large boost for air cargo, with many cargo operators making sizeable profits and many airlines depending on it for survival. This resulted in increased orders for freighter aircraft as well as an increase in conversions of aircraft into freighters. However, the histrory of air cargo is one of dramatic cyclical shift in fortunes, depending on the development of the world economy. What seems safe to say is that, as per a forecast by Boeing (link), the share of air cargo linked to Asian economies will continue to grow for many years ahead (from just above 50% in 2017 to 60% over the next 20 years). A report from just a few weeks ago from IATA (link) stated that cargo volumes increased in August 2021 compared with August 2019, i.e. even when compared with pre-COVID levels. Air cargo demand was 7.7% higher in August this year, again comapred to August 2019 and at the same time capacity was down with 12% in the same comparison, setting up a favourable situation for pricing for cargo operators. The cargo load factor was 54%, which is 10 percentage points higher than in August 2019. Overall, the market situations continues to look good for air cargo and there are some who predict that the increased focus on cargo operations represents a “structural shift” in the industry (link).

From a pilot perspective, transporting passengers has always had a higher status than transporting air cargo. Perhaps because of traditions, pay and other reasons, but also because older aircraft are normally used for cargo operations. With the pandemic and relentless competition and cost pressure among passenger airlines, the difference in status may however gradually be shrinking. Large cargo operators, such as FedEX and UPS, offer competitive career opportunities for pilots. It may be that the old myths about differences between airline pilots and “freight dogs” (link to characterstics of “freight dogs here – link) will surely live on, but during the pandemic many pilots shifted from to air cargo operators and some seem to have found that there are advantages to this type of operation.

This was just a few pieces of information about air cargo and freighter operations, but hopefully we can return to this topic to further explore it. If there are any cargo pilots out there who can provide some guidance and information, or even write a guest post, about air cargo operations that would be warmly welcomed.

Airline tickets via capsule surprise machine – works in Japan!

This is intended to be a serious blog about the aviation industry, but even on a serious university blog there should be exceptions for what is unusual, fun and maybe even unusually fun news. One such piece of news comes from Japan, where the low-cost regional operator Peach Aviation has managed to come up with a new and innovative way of selling airline tickets (well, at least new to me). Given the intense competition in the industry any way to get an edge on competitors may be a good one and Peach has taken this to a new level (link below).

The new sales method is to sell tickets to random destinations via a “Gapachon machine”, which simply is the kind of machine often used to sell small plastic spheres with even smaller plastic toys inside to children. Most of us can probably remember the excitement of using such a machine as children; inserting coins, turning a knob and then getting to open the surprise sphere (rarely did the content live up to expectations, but the process was a reward in itself). Many will probably also remember sighing parents as parts of the battle to get these surprise toys.

Well, Peach now used this very method in a similar way; pay 5000 Yen (44 USD) and receive 6000 Yen (53 USD) worth of mileage points that can be used toward the destination stated on the voucher in the sphere. The airline supports the random destinations with arranged tours, to places like Sapporo, Nagoya, Fukuoka, and Naha. In addition, the bold traveller receives a badge as well as a mission for when they reach their destination.

As reported in the article, there was scepticism within Peach in regards to this new sales method. However, it has become a success and 150 capsules per day have been sold in recent months, with a total of about 3000 tickets having been distributed via this new channel. Given the popularity of this type of machines in Japan, as well as the general popularity of games of chance there, perhaps the success should not have been a surprise. However, not only has it been a success, it has also provided free promotion of the airline since the story about the new sales method has received a lot of attention both in Japan and around the world.

For the couple who cannot agree on where to go for a weekend trip maybe this way of getting a ticket could be practical and fun. Maybe people who are generally indecisive but want to travel appreciate this travel option. It will be interesting to see if this innovation in ticket sales will catch on outside of Japan. It does also make you think about what other methods for selling airline tickets may still be possible to come up with. Throwing darts at a rotating globe? Answer trivia questions on countries and your trip goes to the country for which you had the least number of correct answers? Let friends and family vote where you should go? It seems that there may be more room for innovation here.

Link to article:

Japan airlines’ surprise ticket gapachon machine helps boost sales

Simon Ericson: Återhämtningen stod och stampade i september

Besök gärna Simons webbsida flyg24nyheter.com för fler flygnyheter på svenska från flygbranschen över hela världen.

I september avtog återhämtningen för flygresandet i Sverige och passagerarantalet var något mindre än i augusti. Under juli, augusti och september har passagerarsiffrorna legat stabilt vilket för september visar att affärsresandet kommit igång i den utsträckning att det motsvarar det mer inriktade fritidsresandet under juli och augusti.

Under årets nionde månad flög det 1 601 061 passagerare till och från landets flygplatser enligt Transportstyrelsens flygplatsstatistik. Det är en ökning med 122 procent jämfört med september år 2020 och en minskning med 61 procent jämfört med september år 2019. September är den tredje månaden i rad där passagerarminskningen varit ungefär 60 procent jämfört med före coronapandemin och återhämtningen har efter en ökning mellan maj och juli stabiliserat sig. Även om det är negativt att återhämtningen inte fortsätter uppåt visar passagerarsiffrorna för september att resandet under månaden, som är mer fokuserade på jobbresor än sommarmånaderna, motsvarar samma nivå av resande som juli och augusti där fritidsresenärer dominerar. Affärsresandet ser alltså ut att ha kommit i gång och i kombination med fritidsresandet motsvarar samma passagerarnivåer som under sommaren.

Stockholm Arlanda var, som vanligt, landets största flygplats i september med drygt 886 000 passagerare. Bakom Arlanda följer Göteborg Landvetter, Stockholm Skavsta, Stockholm Bromma och Malmö Airport. Noterbart är att Bromma flygplats visade på en stark ökning av passagerare med 349 procent jämfört med september år 2020 och har återhämtat sig bättre än exempelvis Arlanda och Landvetter jämfört med före pandemin. Anledningen till detta är att Bromma har en stor del inrikesresande vilket är det segment som återhämtat sig bäst hittills.

Under september visade samtliga flygplatser i landet med passagerartrafik på en positiv utveckling jämfört med september år 2020 med undantag för Sundsvall Timrå, Kristianstad och Karlstad. Både Karlstad och Kristianstad har inte haft någon reguljär flygtrafik under hela pandemin och passagerarantalen är små i september, 37 respektive 18. Detta förklarar den negativa utvecklingen där medan det för Sundsvall Timrå är mer bekymmersamt med en negativ utveckling. Sundsvall hade 1 870 passagerare i september i år vilket är fyra procent färre passagerare jämfört med september år 2020. Flygplatsen har under pandemin haft en tillfällig upphandling av flygtrafik till Stockholm varvat med kommersiell trafik med SAS. Sedan början av september flyger SAS återigen på kommersiella grunder mellan Sundsvall och Stockholm. Det har hittills inte givit någon positiv effekt jämfört med föregående år men det är en tydlig passagerarökning mellan augusti och september i år för Sundsvall Timrå Airport vilket ändå visar på en SAS-effekt i september jämfört med augusti när Air Leap flög till Sundsvall.

Noterbart för september är även att Pajala flygplats hade fler passagerare än vad man hade i september år 2019. Flygplatsen ökade antalet passagerare med 34 procent jämfört med september år 2019. De faktiska passagerartalen är dock små, 282 i september i år mot 210 i september för två år sedan, vilket förklarar en del av den relativt sett kraftiga ökningen. Det är givetvis positivt att Pajala åtminstone i september har återhämtat sig från pandemin och flygplatsen har tack vare upphandlad flygtrafik kunnat ha samma utbud som före pandemin.

Det är fortsatt flygplatserna norr om Stockholm som står emot pandemin bäst sett till passagerarsiffror vilket visar på betydelsen flyget har för många regioner i främst Norrland. Ett exempel på detta är att bland de 15 flygplatser som har återhämtat sig bäst i september jämfört med september år 2019 är elva belägna i Norrland medan de övriga är Stockholm Västerås, Visby, Ängelholm Helsingborg och Halmstad. Västerås flygplats har enbart utrikestrafik med Ryanair och denna trafik står uppenbarligen bra mot pandemin eftersom flygplatsen endast hade 24 procent färre passagerare i september jämfört med samma period före pandemin. För Visby flygplats är den positiva återhämtningen beroende på att flyget har en stor betydelse för förbindelser från Gotland till fastlandet. Flygplatserna Ängelholm Helsingborg och Halmstad ligger bland de sista på topp 15 listan över återhämtning men presterar bättre än många andra flygplatser i landet. Detta beror främst på att flygplatserna nästan uteslutande har inrikestrafik och också på att alternativa resvägar till Stockholm än flyg är begränsade jämfört med exempelvis Göteborg Landvetter som också har en stor andel utrikestrafik. Därför sker återhämtningen snabbare på de två förstnämnda flygplatserna medan flygtrafiken i större utsträckning konkurrerar med andra transportmedel på inrikestrafiken till och från Stockholm.

Sammanfattningsvis var september en stabil månad för flygresandet i Sverige där nivån av resenärer håller i sig jämfört med sommarmånadern vilket är positivt. I slutet av september slopades dessutom ett antal restriktioner i Sverige som kan komma att bidra till en positiv utveckling i oktober för flygresandet om resor i tjänsten fortsätter att öka i kombination med att fler semesterresor både inrikes och utrikes görs i takt med färre restriktioner.

Simon Ericson

flyg24nyheter

Who is flying and how much? And is this good or bad?

Those of us who work in the aviation industry tend to think something along the lines of “everyone is flying these days”. Because of this perception, criticism linked to environmental issues that portrays aviation as a “luxury” is not well received. Still, as the rise of low-cost airlines around the world has sharpened an already competitive industry, the result has been lower ticket prices and a growth in the number of flights around the world. With this perspective in mind, it is not unreasonable to think that a vast majority of people in the world are now regularly coming onto an aircraft as passengers. The question is if this insider view of the aviation industry, or the one of aviation as a luxury for few, is the one more representative of the reality. This is probably a topic more suited for a thesis than a blogpost, but perhaps even a limited investigation can reveal something about which perspective that is closer to how things really are.

Starting with the question of who is flying, starting with the country with the largest aviation industry seems relevant, i.e. the US. In 2019 41% of the population had never flown, while another 28% fly once a year. That leaves 31% as regular or frequent fliers (Statista, 2019). In the UK, another country with a large aviation industry, the numbers for 2017 were 12% for those who never fly, with another 11% in the “very rarely” category, 9% in “rarely” and 30% in “occasionally”, leaving 38% as frequent fliers (Statista, 2017). Similar numbers for other countries were more difficult to find but as another example the total number of passengers flying to, from and within India in 2019 was 167 million (World bank, n.d). Even wrongly assuming that all those passengers were Indian, it would still represent a small fraction of its population. Looking at the number passengers carried for other countries in the same way gives the same picture, especially for developing countries. Adding to that some statistics on travel frequency per income and for the big picture there is not much more to reveal; it is true that even in developed countries where many fly, the majority do not fly often and those who do are in higher income brackets. For developing countries, flying remains a luxury for the few.

However, it is at the same time true that there has been an incredible increase of flying in recent decades; from less than half a billion passengers per year in 1970 to 4.4 billion in 2019 (World bank, n.d). This has had a dramatic effect for people around the world, even for those who only fly rarely. To focus only on one example, consider remittances, which is money sent as support from people working in another country back to family or other dependents in their home country. One specific example is the remittances from sent from Filipino workers overseas to their home country, which from grew from 103 million USD in 1975 to 10.7 billion in 2005 (BLES, 2006). The top countries in the world for remittances measured in total amount of money sent home are India, China, Mexico, Philippines, Egypt, Nigeria, Pakistan, Vietnam, Bangladesh and Ukraine. Among the countries who depend most on remittances are Haiti, Nepal, Gambia, Moldova and Honduras. For these countries remittances represent around 20-30% of GDP, i.e. critical for the economy. This is money that makes a big difference in the lives of people who really need this support. According to the UN (link), remittances are three times more important than international aid and growing. Half of that money goes straight to rural areas, where the world’s poorest live. The UN states that this money “is key in helping millions out of poverty” and help in achieving at least seven of the 17 goals of the 2030 Sustainable Development Agenda (among them: no poverty, zero hunger, good health and well-being, quality education and clean water and sanitation). It would be a better world where people did not have to leave their families to support them, but in the world we live in this is the reality for many and without aviation it is difficult to see how this flow of income would be possible.

Which of the two perspectives on the aviation industry could we say is closer to reality – “everyone is flying” or “aviation is a luxury”? As so often, the more accurate picture is probably somewhere in between these two extremes. It is true that in most countries, the majority of the population fly rarely or not at all. It is however also true that there has been a dramatic increase of how many who flies in recent decades and that this has provided many benefits to many people. Many of those new passengers, even if they fly rarely, are working in other countries and improving the lives of many more. To what extent this more nuanced picture can influence views on the aviation industry is difficult to say, since one part of the picture can of course be much more emphasised than the other in support of whatever view someone had already. It should be possible to find agreement on that the aviation industry provides an essential service in a globalised world, as well as on that the current contribution to the environment from the industry needs to be swiftly and significantly reduced. Such an agreement would mean that we all can focus on how to get to a cleaner aviation industry, rather than on the current disagreements.

Some not so big (but interesting) airline news

When it comes to airline industry news there are plenty of articles and comments on manufacturers (mostly Airbus and Boeing) and the big airlines. Beyond that things get a bit more patchy when it comes to coverage. At the blog of Lund University School of Aviation we do cover big news but we also like different perspectives and diverse news (such as the opposite last week about food waste or this one about zombies airlines). Today the focus is on airline news that is not so big, but for different reasons still quite interesting.

First out is the news that the Vietnamese low-cost Bamboo Airways recently operated its first direct flight to the US (link to article below). In a time where many of the long-haul low-cost airlines that was started in the recent decade has disappeared or suffered badly, this is actually quite sensational. Especially as the national carrier Vietnam Airlines was expected to be first with this, but will now have to play catch-up, even after two decades of preparation (as per their own statement). It remains to be seen how the competition between the national carrier and its younger low-cost rival will play out, but that there even is competition is interesting enough to make it into this news compilation.

Next up is the national airline of Bahrain, Gulf Air, which recently announced flights to Tel Aviv in Israel (link to article below). Flights between Gulf countries and Israel had already been started in recent years, following the Abraham accord and normalisation of relations between countries in the region. Still, given the unexpected and historical change this represents more announcements of flights is still a piece of news worthy of attention.

The last piece of these not so big but interesting news is about Fly Okavango. This is a new luxury airline that aims to connect Europe and the US to the Okavango delta in Botswana. The same area is called “the jewel of the Kalahari” and is known for its unique wildlife. The plan is to operate a Boeing B767 in what s seems to be a business class only setting of 96 flatbed seats. Targeting passengers with more money than time the aim is to start with two routes, one from Munich and one from Palm Beach, Florida. To make more interesting, the plan going forward seems to be to increase the number of routes when am advertised Airbus A340 doubles the fleet next year.

That is it for this post. If our readers have any tips on news they would like to see covered or maybe even write about on this blog – just let us know in the comments or by sending an email to nicklas.dahlstrom@tfhs.lu.se. The different and diverse your suggestions are, the more likely that we will write about them.

Link to articles:

Bamboo Airways launches ‘historic’ direct Vietnam -US flight

Bahrain’s Gulf Air launches direct flights with Israel’s Tel Aviv on September 30

Simon Ericson: Varför satsar flygbolagen på flygskammens land?

Besök gärna Simons webbsida flyg24nyheter.com för fler flygnyheter på svenska från flygbranschen över hela världen.

Den senaste tiden har Ryanair, Finnair och Lufthansabolaget Eurowings tillkännagivit att man öppnar upp baser på Stockholm Arlanda och med det öppnar upp många nya flyglinjer. Men varför väljer flera flygbolag nu att satsa på Sverige, flygskammens hemland, när flygbranschen återhämtar sig?

Ryanair, Finnair och Eurowings ska etablera baser på Arlanda flygplats. För Ryanair och Eurowings är det Boeing 737 respektive Airbus A320 som ska flyga inom Europa medan Finnair ska flyga långlinjer med Airbus A350 från Stockholm. Det är tre signifikanta etableringar på den svenska flygmarknaden genom att man baserar flygplan på Stockholm Arlanda Airport när Ryanair satsar på Arlanda i stället för Skavsta, Finnair baserar Airbus A350 utanför Finland för första gången och Eurowings startar sin femte bas utanför Tyskland. Ryanair tillför 22 linjer, Finnair fem långlinjer och Eurowings 20 linjer framöver till Sverige och Stockholm, en del av linjerna trafikeras redan idag medan vissa blir helt nya.

Redan före coronapandemin minskade antalet resenärer på den svenska marknaden och pandemin har sedan inneburit att resandet rasat och nu befinner sig i en återhämtningsfas. Minskningen före coronapandemin berodde bland annat på flygets klimatpåverkan och ”flygskam”, men också en avtagande ekonomisk utveckling påverkade. Sverige utmärkte sig dock bland de europeiska länderna med en negativ utveckling för flygtrafiken och detta berodde på en minskad kapacitet som bland annat ett svar på en lägre efterfrågan på grund av flygskam. Med detta i baktanke är det troligen så att den svenska flygmarknaden kommer att få det tuffare än andra marknader att återhämta sig. Ryanair, Finnair och Eurowings verkar dock inte tro detta eftersom de satsar på den svenska flygmarknaden.

Coronapandemin har inneburit att flygtrafiken minskat kraftigt och flygbolagen letar efter nya platser där man kan använda sina flygplan och generera intäkter. Exempel på detta är att en del passagerarflygbolag börjat flyga mer frakt, Wizz Airs inrikestrafik i Norge och TUIs försök till vinterflyg till Sälen från inrikesdestinationer i Sverige. Man söker sig alltså mot marknader som påverkats mindre av pandemin än andra i hopp om att lindra det ekonomiska blodbad som pågått och pågår. För Finnair och Eurowings är det troligen detta som påverkar flygbolagen att expandera i Sverige trots den svenska marknadens negativa utveckling före pandemin. Finnair har för många långlinjeflygplan i flottan i förhållande till efterfrågan på långlinjer som utgår från deras hemmanav i Helsingfors medan Eurowings befintliga marknader i centrala Europa har som de flesta minskat under pandemin och i stället letar man nya intäkter genom att etablera sig på nya marknader. Ryanair skiljer sig i viss mån mot de övriga två eftersom en del av Ryanairs etablering på Arlanda sker på bekostnad av bolagets flyglinjer på Skavsta som läggs ner under vintertidtabellen. Samtidigt har Ryanair inte haft någon bas på Skavsta flygplats sedan i början av år 2020 och därför innebär basen på Arlanda att man ändå gör en ny satsning på den svenska marknaden.

Förutom att de tre flygbolagen försöker att hitta nya strömmar av intäkter genom att ge sig in på den svenska marknaden är en minskad konkurrenssituation i Sverige troligen en faktor som bidrar till flygbolagens beslut.

Under pandemin har Norwegian minskat sin verksamhet kraftigt vilket minskat konkurrensen på inrikes- och utrikeslinjer till och från Stockholm. Under sommaren i år har lågprisbolaget dock återstartat en del linjer från Arlanda, men det har varit relativt lite lågpris-närvaro på Arlanda och troligen är det detta lågprisbolagen Ryanair och Eurowings ser som en möjlighet att ta marknadsandelar i Sverige. Pandemin har också inneburit att långlinjetrafiken minskat kraftigt från Stockholm och det är troligtvis det som Finnair ser som en möjlighet för bolaget. Sverige har också en lägre konkurrens jämfört med andra marknader i Europa. I exempelvis Spanien kan flygbolag som easyJet, Vueling, Ryanair, Volotea, Iberia och Air Europa konkurrera på samma marknad medan det i Sverige oftast är två flygbolag, främst SAS och Norwegian, som konkurrerar på flyglinjerna. Detta kan också vara en faktor som gör att Ryanair och Eurowings väljer Sverige, för att undgå konkurrens från många flygbolag. Dessutom fanns det indikationer före pandemin på att lågprisflygbolagen inte påverkas av flygskam på sätt som övriga flygbolag.

Det är intressant att se hur tre flygbolag väljer att satsa på flygskammens land, Sverige, i spåren av pandemin som delvis förändrar förutsättningarna för flygbolagen. Möjligen är det så att alla av Ryanair, Finnair och Eurowings inte hade etablerat baser på Arlanda om inte pandemin inträffat. Med en jakt på intäkter från nya marknader och viss mån en minskad konkurrens i Sverige ser flygbolagen uppenbarligen möjligheter i Sverige. Om det faktiskt blir en framgång återstår att se.

Simon Ericson

flyg24nyheter

Airline food – not to be wasted (for environmental reasons)!

When it comes to the aviation industry and the environment the most critical issue is of course the contribution of CO2 and other greenhouse gases and their effects on the climate. However, this is not the only important environmental challenge for the industry, as ozone and fine particles are also emitted from aircraft. In addition, noise pollution, and water pollution from fuel and de-icing chemicals are other negative effects that need to be managed. However, food waste provides yet another environmental challenge to the industry.

There have been more than enough jokes about airplane food over the years. The issues associated with preparing, distributing and taking care of food on aircraft is not something that has been covered on this blog before (well, it has been addressed once, but that was in Swedish – link). As the blog aims to cover as much as possible of the full range of issues of interest in the industry, this post will cover the challenges – and interesting potential solutions – to the food waste problem.

That this is a problem that needs to be addressed, which is highlighted by teh fact that IATA published a “Cabin Waste Handbook” just a few years ago (link). In the handbook it is stated that “Cabin waste is costing airlines money, consuming valuable resources, and undermining the sector’s sustainability credibility”. In regards to food, it is estimated that out of the 5.7 million tonnes of cabin waste produced each year 20% is food waste. The expected long-term growth of the aviation industry may mean that the waste may increase significantly with time. It is worth noting the point IATA makes about “sustainability credibility”. Flying is still often seen as a transport mode for rich people and adding food waste to that certainly makes for a less than pleasant perspective on the industry.

All the incentives for an airline are against ending up with any food waste. Still, as providing the best possible service is an important of the product airlines offer, bringing on more food than what is needed is almost inevitable. Different airlines try to address this in different ways. Japan Airlines offers their passengers to opt out of meals before their travel. Some airlines, including Cathay Pacific, donates what is left untouched to food banks in Hong Kong. More advanced methods, such as using image recognition to identify the least popular items, are also being used. Airports also try to find ways to handle food waste. Santiago International Airport sells food with a discount as it comes close to expiration dates. Denver International Airport is working with a nonprofit organisation to make good use of food that would otherwise be wasted.

An interesting initiative comes from Swiss, who have partnered with the company “Too Good To Go” (see link to article below). This is a company that works with grocery stores, restaurants, caterers, hotels, and other in the food industry to minimise food waste. This is done by selling food that would otherwise go to waste via an app for a heavily discounted price. Even though SWISS also uses data and analysis to only take as much food as will be handed out or sold, the match between what if offered and what is consumed will rarely be perfect. If there is leftover food, a few items will each go into different bags and then offered to passengers for a price as low as a third of the original cost. This does not only save food from being wasted, it also provides a small income for the airline (better than getting no money for the food) and reduces the problem of handling food waste.

With clever initiatives like the one from SWISS, and others previously mentioned, there is a good chance that the problem of food waste can be significantly reduced. Aviation certainly do not need any further reasons for negative publicity in regards to environmental reasons, so there is good reasons to take a problem that is manageable off the table. There may be a challenge to match this with passenger expectations and demands for their meal choice or extra food item. Sometimes these are not easy situations for cabin crew to handle, but maybe the occasional offering of a bargain on a bag of food items will help to highlight the problem (and help someone who still is hungry to manage their challenge).

Link to main article for reference:

SWISS To Slash Price Of Uneaten Food In A Bid To Avoid Waste

Recent Comments